About Lowell

Europe's leading ethical credit management company, with a mission to make credit work better for all: clients, customers and communities.

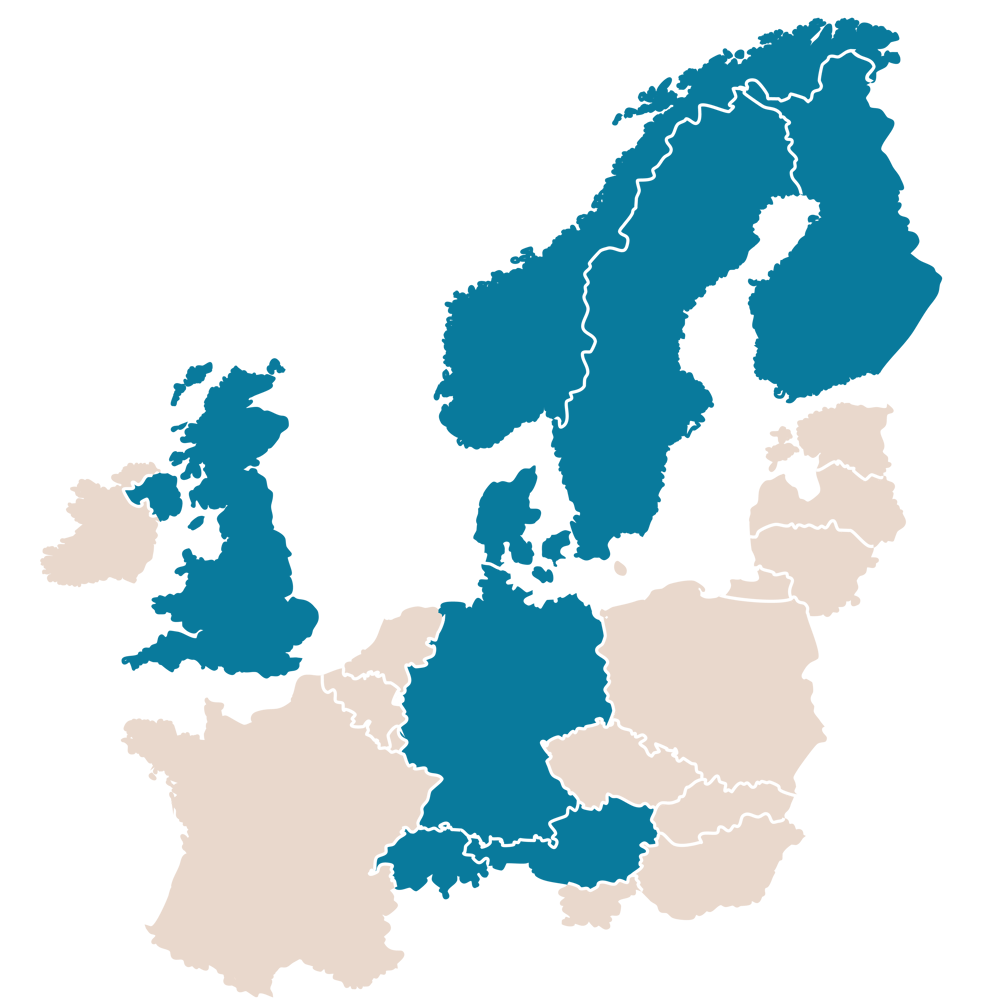

We are one of Europe’s largest credit management companies, operating in the UK and the DACH and Nordic regions. The Group employs over 3,600 people.

History

In 2015, Lowell Group and GFKL Group - the respective UK and German market leaders - merged to form Lowell. We completed the acquisition of the carve-out business from Intrum in 2018, giving us market-leading positions in the Nordic region.

Group businesses

Our business spans eight countries across three operating regions: DACH, the Nordics, and the UK. We don’t just operate across different geography – we’re also alive to the nuanced cultural relationships that people have with debt across these regions, tuning our operating model to align with the varying local norms.

DACH

Lowell Financial Services

Founded in 1992, Lowell Financial Services GmbH - previously known as GFKL - grew into one of Germany's largest financial services businesses. It is now a leading provider of receivables management services. Employing over 1,200 people together with its subsidiaries, it runs Competence Centres for specific sectors in locations across the DACH region, covering:

- Insurance, telecommunications, and travel

- Utilities and public transport

- eCommerce and retail

- Fitness and health

- Publishing

- Financial services

German subsidiaries

- Deutsche Multiauskunftei GmbH

- GFKL Collections GmbH

- GFKL PayProtect GmbH

- Proceed Collection Services GmbH

- Inkasso Becker Wuppertal GmbH & Co. KG

- Sirius Inkasso GmbH

- Zyklop Inkasso Deutschland GmbH

- Tesch Inkasso Finance GmbH

- Tesch Inkasso Forderungsmanagement GmbH

Austrian/Swiss subsidiary

- Lowell Inkasso Service GmbH

The Nordics

Joining Lowell in March 2018, our Nordics businesses are proven players across the Northern European markets with a long history in each country: Finland (1966), Sweden (1981), Norway (1982), and Denmark (1994).

The business consists of a combination of Intrum’s former operations in Norway, and Lindorff’s former operations in Denmark, Finland and Sweden.

Employing over 1,000 people, the Nordics region is active across the full value chain of credit management services with strong capabilities across all client sectors.

The UK

We have two businesses in the UK, Lowell Financial and Overdales Solicitors. Combined, they employ over 1,500 people in Leeds.

Lowell Financial Limited

Lowell Financial is the leading UK provider of credit management services, specialising in debt recovery, data analytics and customer insight. We’re one of the UK’s leading investors in consumer debt portfolios and Europe’s leading player in the credit management industry.

Lowell Financial Ltd is authorised and regulated by the Financial Conduct Authority and is a member of the Credit Services Association.

Overdales Legal Limited

Overdales is a specialist law firm supplying industry-leading litigation and debt recovery services. It recovers outstanding debts through the courts when all other efforts have failed and there is reason to believe the consumer has the means to pay.

Overdales Legal Limited is authorised and regulated by the Solicitors Regulation Authority and the Financial Conduct Authority.

Our mission: to make credit work better for all

We put the customer first, engaging with customers to create personalised solutions that give them control of their debt. As a trusted long-term partner, we help free up liquidity for our clients, protecting their reputation through a flexible, ethical approach to debt purchase and collection.

And we make credit work better for all by employing our experience, expertise, and influence in building a better, fairer society.

-

Tackling the stigma of debt

As leaders in ethical debt recovery, we’re advocating for a standard approach to the language of debt within the debt advice sector. We believe that people struggling with problem debt should not feel ashamed to find themselves in this situation.

-

Improving customer outcomes

We use our considerable data, operational insights, and customer research to help inform government policy and shape the national debt agenda. We’re leading the conversation about problem debt in society, promoting the crucial impact of early engagement on customer outcomes.

-

Delivering financial inclusion

We recognise there’s an urgent need for financial education, particularly for adults at the point of need. We train our colleagues to support customers at the point they become debt-free with Lowell by signposting them to relevant tools and resources.

We also support initiatives and charities that advocate for financial inclusion.

-

Mission accomplishments

Find out more about how we’re achieving our mission in our Sustainability Report.

Ethical approach

We pioneered responsible collections, the ethical approach to simultaneously maximising business performance while protecting the interests of clients, customers, colleagues, and communities.

We use our unparalleled combination of data analytics expertise, deep consumer insight, and robust risk management to give clients sustainable solutions in debt purchasing, third party collections, and business process outsourcing.

Our fair and ethical approach puts us at the forefront of consumer credit and credit collections: we are committed to delivering the most fair and affordable outcome for each customer, tailored to their individual circumstances.